For entrepreneurs who are interested in starting a power bank sharing business, the first choice they face is how to start the business: should they choose to develop independently or adopt the OEM model? How to efficiently start and run a power bank sharing business?

I. Independent R&D: Setting up a technical team, product development and technical realization, later maintenance and operation, and possible problems encountered

If investors choose independent R&D, according to the business requirements, they need to set up technical staff with different functions, such as software development, hardware development, operation and maintenance.

Software developers need to configure APP developers, front-end engineers, back-end engineers, maintenance engineers, test engineers. Hardware developers need to configure: electronic engineers, structural engineers, firmware engineers, test engineers, after-sales support engineers.

The R&D cycle takes 6 months to 1 year, and costs at least a million dollars. Whether it is economic cost, labor cost or time cost, it is a heavy burden for investors. Independent R&D is not a suitable choice for overseas entrepreneurs. Instead, choosing power bank sharing factory OEM can help you start power bank sharing business at low cost and fast.

2. Factory OEM: demand analysis, product planning and design, hardware prototype development, software development, product inspection, production deployment, delivery and training, maintenance and operation, system upgrades

The power bank sharing factory can make flexible adjustments from product design, function configuration, software development, circuit design to cabinet structure design according to customer’s specific needs, to ensure that the products can be perfectly integrated into the local market and enhance customer’s market competitiveness.

1.Demand Analysis

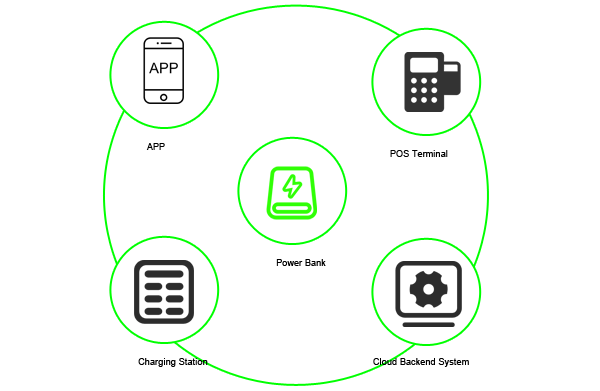

When entrepreneurs choose factory OEM to start power bank sharing business, the development and design will analyze the customer’s needs in detail, including the hardware equipment to be selected and customized as well as the required software functions.

2. Design and Planning

Based on the requirement analysis, we design and plan the overall solution. Including hardware customization, software, interface design, user experience and so on.

3.Hardware prototyping

According to the customer’s needs, prepare raw materials, and use raw materials and production equipment to make samples. After the samples are inspected and approved by customers, mass production can be carried out.

4.Software Development

Meanwhile, the software development team carries out software development according to the software design program. This includes writing code, integrating payment, designing UI, user interface programming, etc.

5.Product Inspection

After completing the hardware prototyping and software development, strict tests on function, performance, compatibility, security, etc. are carried out to meet customer requirements.

6.Production Deployment

After product verification, the solution enters the production phase. This includes mass production of hardware devices, deployment of software, and so on.

7.Delivery and Training

Finally, the solution is delivered to the customer and the necessary training is provided to ensure that the customer can properly use and maintain the entire solution.

8. Post Maintenance and System Upgrade

After the delivery of the product, power bank sharing factory provides comprehensive after-sales maintenance services. Product repair, maintenance, upgrading and technical support. A perfect after-sales service system has been established to ensure that customers can get timely solutions when they encounter problems in the process of using the products.

In order to meet the market demand, power bank sharing factory provides customers with system upgrade service: remote upgrade of hardware, software update and so on. Through system upgrading, our products and services can always stay in the forefront of the industry, creating strong market competitiveness for our customers.

3. How to reduce the investment risk of power bank sharing?

3.1. Understand the market in depth and whether there is room for local market development

The concern is the scale and growth rate of local mobile Internet users. A region with a large and continuously growing mobile Internet user base has a huge potential demand for power bank sharing.

It is also important to examine the local consumer acceptance and usage habits of power bank sharing, as well as the existing power bank sharing brands and competitive landscape in the local market. This information can be obtained through market research, market analysis reports, questionnaire surveys, consumer interviews, etc., to help investors make accurate judgments about the potential and competitive heat of the local market.

As investors delve into the market, it is important to analyze the major competitors in the market in detail. This includes understanding the competitors’ brand awareness, market share, product features, service quality, pricing strategies, and other aspects. Through comparative analysis, investors can identify gaps and differentiation opportunities in the market to provide reference for their own project positioning and development strategies.

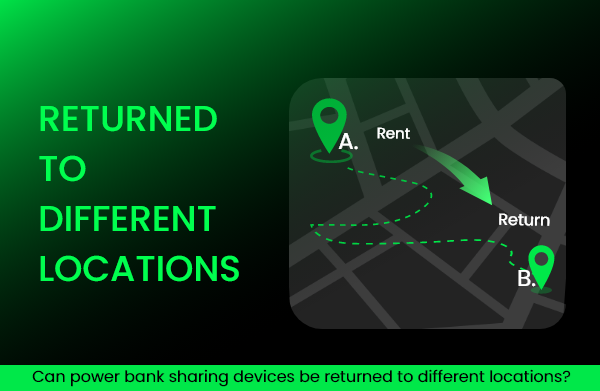

How to create differentiated competitive advantages? Investors can start from product features, user experience, service model and other aspects. For example, launch a charging treasure with faster charging speed and larger capacity, or provide more convenient and efficient rental and return services. Explore diversified profit models such as cooperating with merchants and placing advertisements to increase the project’s revenue sources and profitability.

3.2 Examine partners’ qualifications: R&D capability, company’s business status, credibility and strength.

How to accurately examine the qualifications of partners, especially R&D capability, company operation status, credibility and strength, has become a skill that every decision-maker must master.

R&D capability is an important indicator of whether a company can continuously launch new products, optimize existing technologies and respond to market changes. To examine the R&D capability of a partner, you need to focus on the following 3 aspects:

R&D team strength: Understand the size of the partner’s R&D team, the background of its members (e.g., education, professional experience), the team structure (e.g., whether it covers key aspects such as research and development, testing, design, etc.), and the stability of the team. Partners with high-quality, diversified and stable R&D teams represent stronger innovation and project execution.

R&D investment: Check the percentage of R&D budget, the growth trend of R&D investment over the years, and the output efficiency of R&D results.

Technology Patents and Intellectual Property Rights: The quantity and quality of technology patents are important indicators of an enterprise’s R&D achievements. By checking the official website of the State Intellectual Property Office and other websites, you can obtain the patent information of your partners and understand their technical barriers, core competitiveness and market potential.

4. what are the important measurement indicators of the company’s operating conditions, there are the following 2 points:

4.1 Financial statement analysis: by reviewing the public financial reports of the enterprise, analyze the key financial indicators such as revenue growth rate, net profit margin, asset-liability ratio, etc., to understand the profitability, solvency and operational efficiency of the enterprise. Special attention should be paid to the comparison of the data of consecutive years in order to judge the development trend of the enterprise.

4.2 Market share and competitiveness: Examine the enterprise’s market share in the target market, competitors’ situation, product line layout and market reaction speed. Investors can use the information in these areas to assess the market position and growth potential of the enterprise in multiple dimensions.

① Understand the profit model and operation and management style

The profitability model is the key for investors to be able to sustain the operation of the power bank sharing project and generate revenue. When investors have a clear understanding of where and how to generate profit, they can know the return on investment cycle and minimize investment risk.

② Diversified Profit Models

If a project has only a single profit model, investors are exposed to higher risks when market changes, fluctuations in consumer demand, or increased competition may impact the business.

The unique business characteristics of power bank sharing can span multiple business fields, not only limited to rental income, but also covers a variety of profit channels such as advertising income, additional service income, etc., which has a stronger market adaptability and risk-resistant ability.

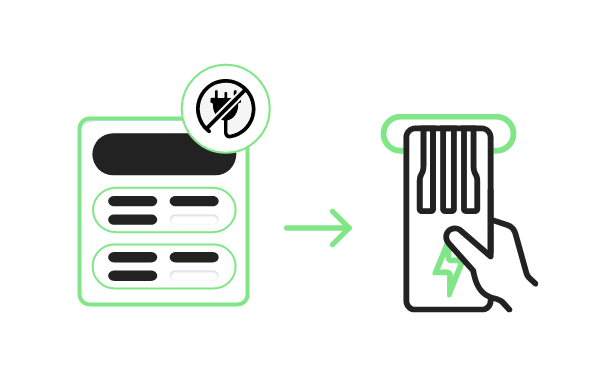

③ Operation management mode

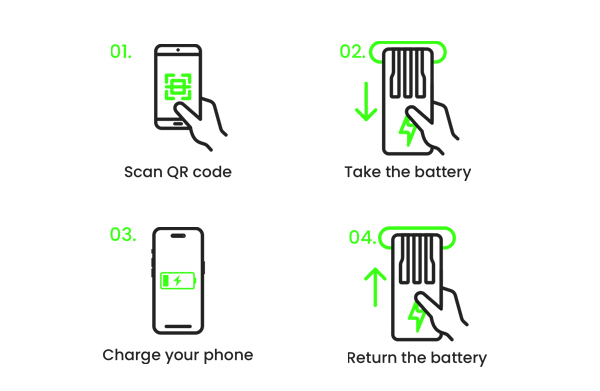

Power bank sharing realizes 24-hour uninterrupted service through the unattended mode, users can complete the rental operation by themselves, and can run the project across the region without the need for transitional manual intervention, reducing the investor’s cost investment.

Investors can put the equipment in areas with high traffic and high demand for cell phone charging: shopping malls, airports, entertainment and other places to scientifically optimize the layout of outlets and increase the use rate and revenue of users.

power bank sharing technology platform, developed the technology of automatic fault detection, to realize self-service management and maintenance equipment. You can quickly open business in multiple countries and cities, and no longer need to worry about the problem of not being able to deal with the equipment when it fails. power bank sharing technology platform provides you with a low-cost, the most efficient and convenient technology system, so that you can easily manage all the equipment.

4.3. Field inspection/authoritative organization verification, whether false propaganda

① Field inspection

Investors need to go to the location of the object of cooperation, attention is to have a production plant, R & D center, production line, product display. Through personal experience, investors can intuitively feel the real situation of the enterprise, to avoid being misled by promotional materials.

Direct communication with the person in charge of the enterprise or core team members, to understand the project’s business model, profit model, development planning and other key information, a real sense of the team’s professionalism. Put their own doubts to ask questions, observe whether the other party’s answer is sincere, whether the logic is clear, in order to determine the reliability of the cooperation object, whether it is worth investing.

② Authoritative organization verification

Based on cost or other considerations, investors can not go to the field to inspect the object of cooperation, you can use a third-party platform to fully verify the qualifications of the enterprise.

Alibaba International as the world’s largest B2B platform, in order to help overseas customers understand the strength of the supplier’s factory, the supplier’s factory on-site audits and assessments, factual display of the factory’s operating capacity, production scale, quality management, technical level, to help customers further understand the factory’s current real production capacity and quickly make decisions.

The platform will form an in-depth factory inspection report, which contains 720 ° VR panoramic photos, videos, so that customers can examine the situation of the supplier’s factory up close without leaving home.

Eight Borrowers Charging has successfully replicated the power bank sharing business model to more than 100 countries, and provided a complete set of customized solutions for 500+ global partners.

If you want to successfully replicate the power bank sharing business model overseas, Borrowed Charge is your reliable partner, providing you with a complete set of solutions and the most valuable experience on the ground.

January 19, 2025